The lawsuit involving Colony Ridge has become one of the most talked-about legal disputes in Texas real estate. What began as a large-scale affordable land project is now at the center of serious allegations involving deceptive practices, seller financing, and consumer protection concerns.

This case is not just about one development. It touches on immigration policy, housing access, and how far private developers can go when offering financing directly to buyers.

What Is Colony Ridge?

Colony Ridge is a massive residential land development located in Liberty County, Texas, northeast of Houston. The project markets small plots of land to buyers who often cannot qualify for traditional bank mortgages.

Instead of using banks, the company offers seller financing. That means buyers make payments directly to the developer rather than through a lender.

For many families, especially first-time buyers and immigrants, this seemed like an opportunity to own property without strict credit checks.

But critics argue that the structure of these deals created serious risks.

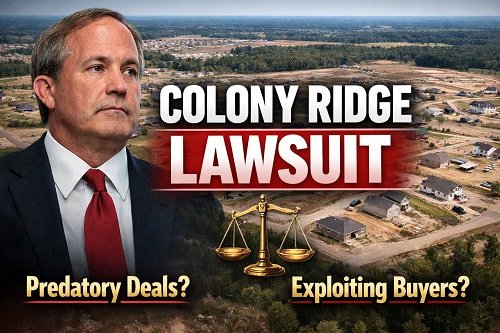

Who Filed the Lawsuit?

In 2023, the Office of the Texas Attorney General filed a lawsuit against the developers behind Colony Ridge. The case was led by Ken Paxton.

The state accused the developers of deceptive trade practices and misleading buyers. According to the complaint, some purchasers were not fully informed about loan terms, infrastructure conditions, and the risks involved.

The lawsuit claims that vulnerable buyers were targeted and that certain disclosures were unclear or incomplete.

The Core Allegations

The legal complaint centers on several key issues.

1. Seller Financing Practices

One of the biggest concerns involves how the land was financed. Seller financing can be legal and useful. However, the state alleges that interest rates, late fees, and foreclosure terms may not have been clearly explained.

If a buyer missed payments, they could lose the property quickly under contract terms. Critics argue that this created a cycle where land could be foreclosed and resold multiple times.

2. Infrastructure Concerns

Another issue involves roads, drainage, and utilities. Reports have surfaced claiming that some areas lacked proper infrastructure when lots were sold.

There have also been concerns about flooding risks in certain sections. The lawsuit suggests buyers may not have been fully aware of these risks before signing contracts.

3. Marketing to Non-English Speakers

The state also alleges that marketing heavily targeted Spanish-speaking communities. While marketing in another language is not illegal, the lawsuit claims some buyers may not have fully understood the legal and financial obligations they were accepting.

Clear communication in contract law is essential. If buyers do not fully understand terms, disputes often follow.

The Developer’s Response

The developers of Colony Ridge deny wrongdoing.

They argue that:

● Buyers willingly entered contracts.

● Seller financing was clearly outlined.

● Thousands of families have successfully purchased land.

● Infrastructure improvements were ongoing and disclosed.

Supporters of the project say it gave families a chance at land ownership when banks would not approve them. They view the lawsuit as politically driven rather than consumer-focused.

The company maintains that it complied with Texas law.

Why This Case Matters

This lawsuit is significant for several reasons.

First, Colony Ridge is enormous. It is considered one of the largest residential developments in Texas history. Any ruling could affect thousands of homeowners.

Second, the case could reshape how seller-financed land deals operate in Texas. If the state succeeds, stricter rules and clearer disclosure requirements may follow.

Third, the lawsuit intersects with broader debates about immigration and housing access. Because many buyers were immigrants, the case quickly became part of a larger political conversation.

What Could Happen Next?

The case is still moving through Texas courts. Legal disputes of this scale take time. Possible outcomes could include:

● Financial penalties

● Court-ordered changes to business practices

● Consumer restitution

● Dismissal of claims

Until a final ruling is issued, all allegations remain claims rather than proven violations.

Lessons for Land Buyers

Regardless of how this case ends, it offers important lessons for anyone considering seller-financed property.

Always:

● Read contracts carefully

● Ask for translations if needed

● Understand interest rates and penalties

● Review flood maps and infrastructure details

● Consider speaking with a real estate attorney

Seller financing can open doors. But it also shifts risk onto the buyer.

Final Thoughts

The Colony Ridge lawsuit raises a difficult question: Was this development a path to opportunity, or a system that exposed vulnerable families to financial harm?

Supporters see access and growth. Critics see aggressive sales tactics and risky contracts.

The courts will ultimately decide where the truth lies. Until then, the case remains one of the most closely watched real estate disputes in Texas.

Satyakam Pradhan is a professional law content writer with extensive experience in creating clear, well-researched, and reader-friendly legal content. With a strong understanding of laws and legal procedures.