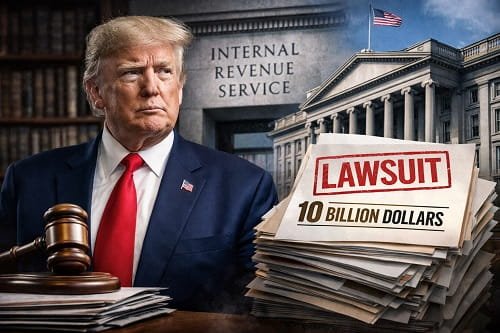

Former U.S. President Donald Trump has filed a massive $10 billion lawsuit against the Internal Revenue Service (IRS) and the U.S. Treasury Department. The case also includes his sons, Donald Trump Jr. and Eric Trump, along with the Trump Organization.

At the center of this legal fight is one serious accusation: the U.S. government failed to protect Trump’s private tax records.

This is not just another political headline. It raises big questions about data privacy, government responsibility, and how much protection any citizen — even a former president — really has when their personal information sits inside federal systems.

Let’s break it down.

What Sparked the Lawsuit

Several years ago, confidential tax information belonging to Donald Trump and his business empire was leaked to the media. These records were later used in detailed reports about Trump’s finances.

Investigators found that the leak came from a former IRS contractor, who illegally accessed and shared thousands of tax files. He later pleaded guilty and received a prison sentence.

Trump’s lawsuit argues that this never should have happened.

According to the complaint, the IRS and Treasury Department failed in their basic duty to safeguard sensitive taxpayer data. Trump claims the agencies allowed weak controls, poor oversight, and careless handling of private records.

In simple words: the lawsuit says the government dropped the ball.

Why Trump Is Asking for $10 Billion

The amount raised eyebrows right away.

Trump’s legal team says the leak caused:

- Serious damage to Trump’s personal reputation

- Harm to his businesses

- Public embarrassment for his family

- Long-term political and financial consequences

Tax returns are among the most protected documents in the U.S. system. When those details become public, the damage can’t be undone.

Trump argues that once his financial data was released, it spread everywhere. Headlines followed. Opinions hardened. Business relationships were affected.

From his side, the harm was permanent — and that’s why the lawsuit seeks such a large figure.

Why This Case Is Unusual

This lawsuit stands out for several reasons.

First, Trump is suing federal agencies that are part of the same government structure he once led. That’s rare.

Second, the case is not about taxes owed or audits. It’s about privacy and security failures.

Third, it follows criminal convictions already connected to the leak, which strengthens Trump’s argument that real wrongdoing occurred.

And finally, the case comes at a time when trust in institutions is already fragile. Any ruling here could set an important example for how data breaches inside government agencies are handled in the future.

The Bigger Issue: Can the Government Protect Your Data?

This lawsuit goes far beyond one person.

Every citizen who files taxes hands over deeply personal information — income, investments, family details, business records. People assume that data stays locked away.

Trump’s case challenges that assumption.

If someone inside the system can access and leak tax records of a former president, it naturally raises concern about ordinary taxpayers too.

The lawsuit forces a difficult question into the open:

If the IRS couldn’t fully protect Trump’s information, how safe is anyone else’s?

That’s why privacy experts are watching closely.

What Happens Next

The case has been filed in federal court in Florida. Over the coming months, lawyers on both sides will argue about:

- Whether the IRS failed its legal duty

- How much responsibility falls on the agencies versus the individual contractor

- Whether Trump can prove direct financial harm

- And if compensation at this scale is justified

These cases move slowly. There will be motions, hearings, and possibly settlement talks before anything close to a final decision.

Satyakam Pradhan is a professional law content writer with extensive experience in creating clear, well-researched, and reader-friendly legal content. With a strong understanding of laws and legal procedures.