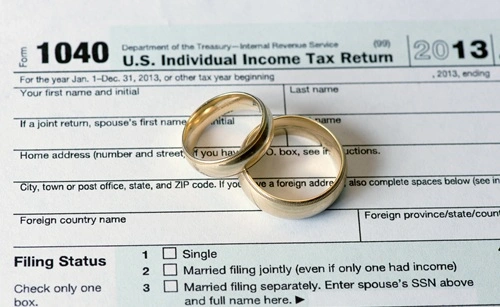

Filing your taxes can be confusing, especially when it comes to choosing the right filing status. Many married individuals wonder if they can file as “single” to simplify things or reduce their tax bill. But here’s the hard truth: if you are legally married, filing as “single” is considered tax fraud—and yes, you can go to jail for it. The IRS takes false tax filings seriously, and misrepresenting your marital status can lead to civil penalties, criminal charges, and even prison time.

Let’s break down when filing as single is illegal, the possible penalties, and what you should do instead if your marital situation is complicated.

What the IRS Considers “Married”

Under U.S. tax law, your marital status for tax purposes is determined by your situation on December 31 of the tax year. If you are legally married on that date—whether or not you live with your spouse—you cannot file as “single.”

You’re considered married if:

- You are legally married and not divorced by the end of the year.

- You are separated but not legally divorced.

- You live apart but have no formal legal separation decree.

In these cases, the correct filing statuses are:

- Married Filing Jointly, or

- Married Filing Separately.

You may also qualify as Head of Household in certain cases (such as living apart from your spouse and supporting a dependent), but “single” is never legal if you are still married.

Why Filing as Single Is a Crime

Filing as “single” when you’re actually married is not just an innocent mistake—it’s a false statement to the federal government. The IRS views it as tax fraud because it misrepresents your financial and legal status to reduce your tax liability.

This act can violate several federal laws, including:

- 26 U.S.C. § 7206(1) – Filing a false tax return (punishable by up to 3 years in prison and a fine up to $250,000).

- 26 U.S.C. § 7201 – Tax evasion (punishable by up to 5 years in prison and fines up to $100,000 for individuals).

- 18 U.S.C. § 1001 – Making false statements to a federal agency.

If the IRS determines that you knowingly chose the wrong filing status to gain an advantage—such as obtaining a larger refund or lowering your tax bill—you could face criminal prosecution.

The Difference Between Mistake and Intentional Fraud

The IRS understands that honest mistakes happen. If you accidentally file as single due to confusion or misunderstanding, you’re unlikely to face criminal charges—though you’ll still owe back taxes, interest, and possibly civil penalties.

However, if investigators find intentional deception, such as:

- Claiming “single” to hide income from a spouse,

- Using the status to qualify for tax credits you don’t deserve (like the Earned Income Tax Credit), or

- Repeatedly filing incorrectly after warnings,

then it becomes willful tax fraud, which can trigger a criminal investigation and potentially jail time.

Civil and Criminal Penalties

Here’s what you might face if you’re caught:

- Back Taxes: You must repay any tax benefits you improperly received.

- Accuracy-Related Penalty: 20% of the underpaid tax.

- Civil Fraud Penalty: 75% of the underpaid tax (if intentional).

- Criminal Penalties: Up to 3–5 years in prison, plus fines up to $250,000 for individuals.

In some cases, the IRS may refer the matter to the Department of Justice (DOJ) for criminal prosecution, especially if the false filing is part of a broader pattern of deceit (like hiding income or fabricating dependents).

What to Do If You Already Filed Incorrectly

If you realize you’ve filed “single” when you were actually married, act quickly. You can fix the issue by filing an amended return (Form 1040-X) with the correct filing status. The IRS typically views voluntary correction more favorably than if they discover it during an audit.

If you believe the mistake could lead to serious consequences, consult a tax attorney before contacting the IRS. An experienced lawyer can help protect your rights and negotiate with the government if necessary.

Final Thoughts

So, can you go to jail for filing single when married? Yes, you can—but usually only if you do it intentionally. Filing a false tax return is a federal offense, and the IRS prosecutes thousands of these cases each year. Even if you don’t end up behind bars, the financial penalties and long-term damage can be devastating.

When in doubt, be honest and accurate on your tax return. If you’re unsure about your filing status, speak with a certified tax professional or attorney before filing.

In short: lying to the IRS about being single when you’re married isn’t just risky—it’s a crime. And when it comes to federal tax law, honesty is always the best policy.

Our dedicated team gathers information from all the reliable sources to make the law accessible and understandable for everyone. We provide the latest legal news stories from across the country, delivered straight to you.